Are you a first time car owner and need some advice on car insurance? Are you new to Florida and aren’t sure of the basic requirements for car insurance? We have car accident attorneys who know their way around car insurance coverage information!

According to the Insurance Information Institute, in 2019 12.6% of drivers did not have car insurance. In Florida, 20.4% of drivers did not have car insurance. As of June 2021, the necessary car insurance coverage required in Florida is Property Damage Liability and Personal Injury Protection with minimum limits of 10/20/10.

What is PIP, PDL, UM, and BI?

As we stated above Personal Injury Protection (PIP) is required with a minimum of $10,000. PIP is car insurance coverage that protects YOU, no one else, no matter the circumstance of who is deemed at fault. PIP covers all your medical bills up to the limit amount you have. For example, if you have the minimum required PIP coverage, your medical bills will be covered 80% up to the $10,000 everything else would be left for you to cover. Paired with PIP is Property Damage Liability (PDL), this also has a minimum of $10,000 required. PDL is meant to cover another person’s property whether it was damaged by you or someone else who was driving your vehicle at the time of the car accident.

Bodily Injury (BI) insurance is providing coverage toward injury-related costs when multiple people are injured in a car accident when you are deemed at fault. This type of coverage is not required in the state of Florida. BI is typically always recommended to have since the required minimum of PIP is so low.

- However, in accordance to the Florida Law 324.022, BI is required to individuals deemed ‘high risk’ drivers and those minimums are $100,000 per person, $300,000 per accident for bodily injury and $50,000 for property damage. Most car accident lawyers recommend BI because it protects the at fault driver if they find themselves in suit with the person they injured.

Normally what is paired with BI is Uninsured Motorist (UM). UM is probably the best car insurance coverage add-on to the required ones. It protects you just like PIP but in a different way. UM is coverage that comes in handy when the person that is at fault for the car accident has no insurance at all. With UM insurance you can feel comfortable knowing that no matter what car accident you might find yourself in, if you are not at fault you will have UM to help pay for your injuries.

Pros and Cons of Different Levels of Car Insurance Coverage

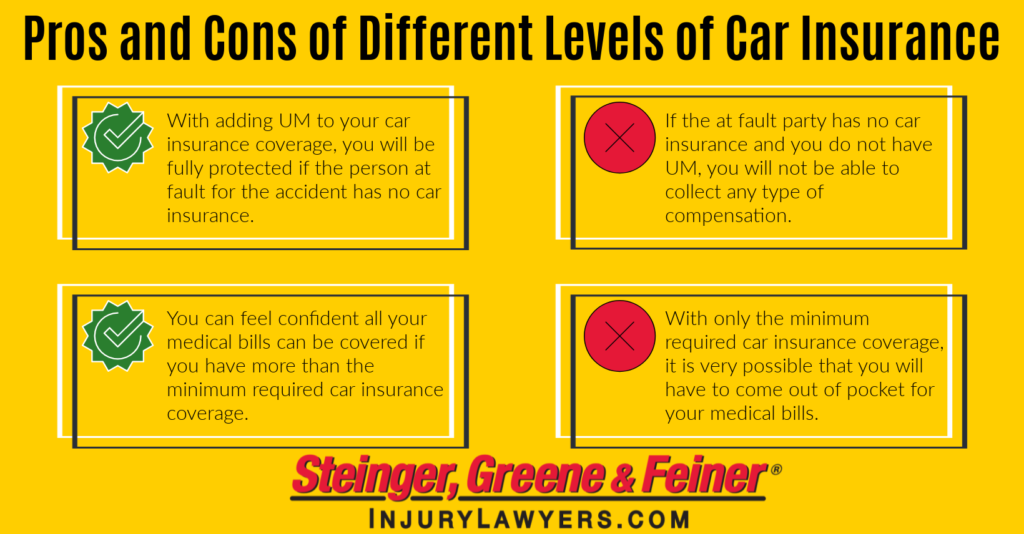

Weighing the positives and negatives of different levels of car insurance coverage is very important when you consider the possibility of being involved in a car accident. Obviously the minimum requirements for coverage seem very enticing. It would keep your insurance payments low each month, you never really think about the amount of money a car accident could cost you! That is, until you find yourself victim of a car accident and badly injured.

When you think about hospital bills, ambulance services, doctor visits, medications, potential surgeries and physical rehabilitation, it can be very daunting if you don’t have enough coverage or if the person who hit you has no coverage. If you wanted to keep the minimum requirements you might still have to come out of pocket whether it’s for medical related bills or for property damage for your car. If you have a Fort Myers car accident lawyer, they will be able to assist in helping you figure out how much compensation you are owed by the at fault party and if they have the coverage to pay for all damages.

But what happens if the at fault party has no insurance or not enough coverage for all of your damages? This is where having UM would be the saving grace. A major positive about adding UM to your car accident insurance coverage will help protect you when the at fault driver has no insurance. Even though UM is not required by the state of Florida and your payments toward car insurance coverage would be higher than if you were to stick to the minimum requirements, it is a great backup plan.

Contact Us For All Your Legal Needs

If you find yourself or your loved one involved in a Fort Myers car accident and are unsure about the amount of compensation you are entitled to, contact one of our Fort Myers car accident lawyers. Our team of experienced legal professionals will offer you the best counsel for your car accident case.